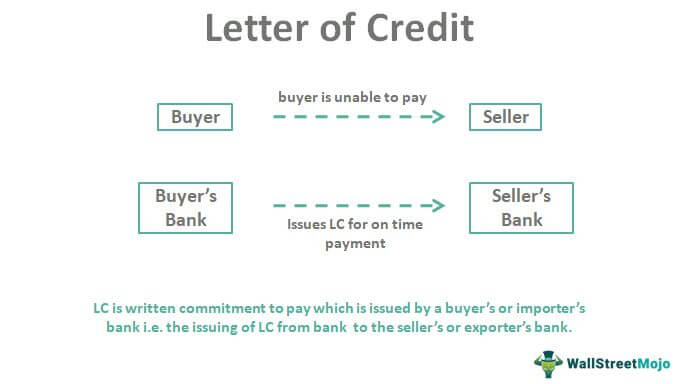

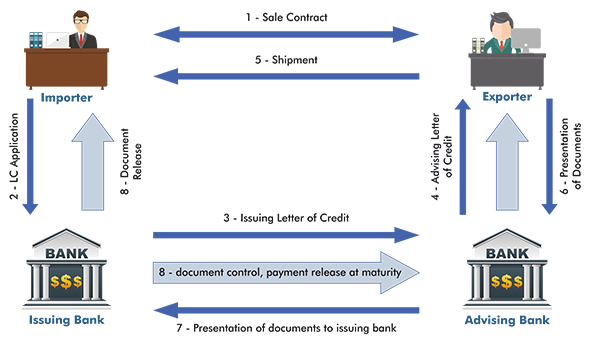

A Letter of Credit LC is a document that guarantees the buyers payment to the sellers. A Letter of Credit is a payment term generally used for international sales transactions.

A letter of credit is a legal document that transfers responsibility for collecting payment for shipped goods and services from your business to your foreign buyers bank.

What is letter of credit. The letter of credit stipulates that if your foreign buyer is unable to pay for the goods that you exported to them your foreign buyers bank will pay your business instead. It is very specific in a way that it is used for regular shipments of the same commodity between the same buyer importer and the seller exporter. While not usually required by.

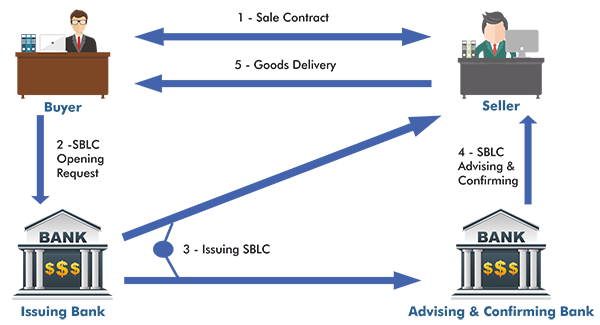

If the buyer is unable to make such a payment the bank covers the. What is a letter of credit. Through its issuance the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

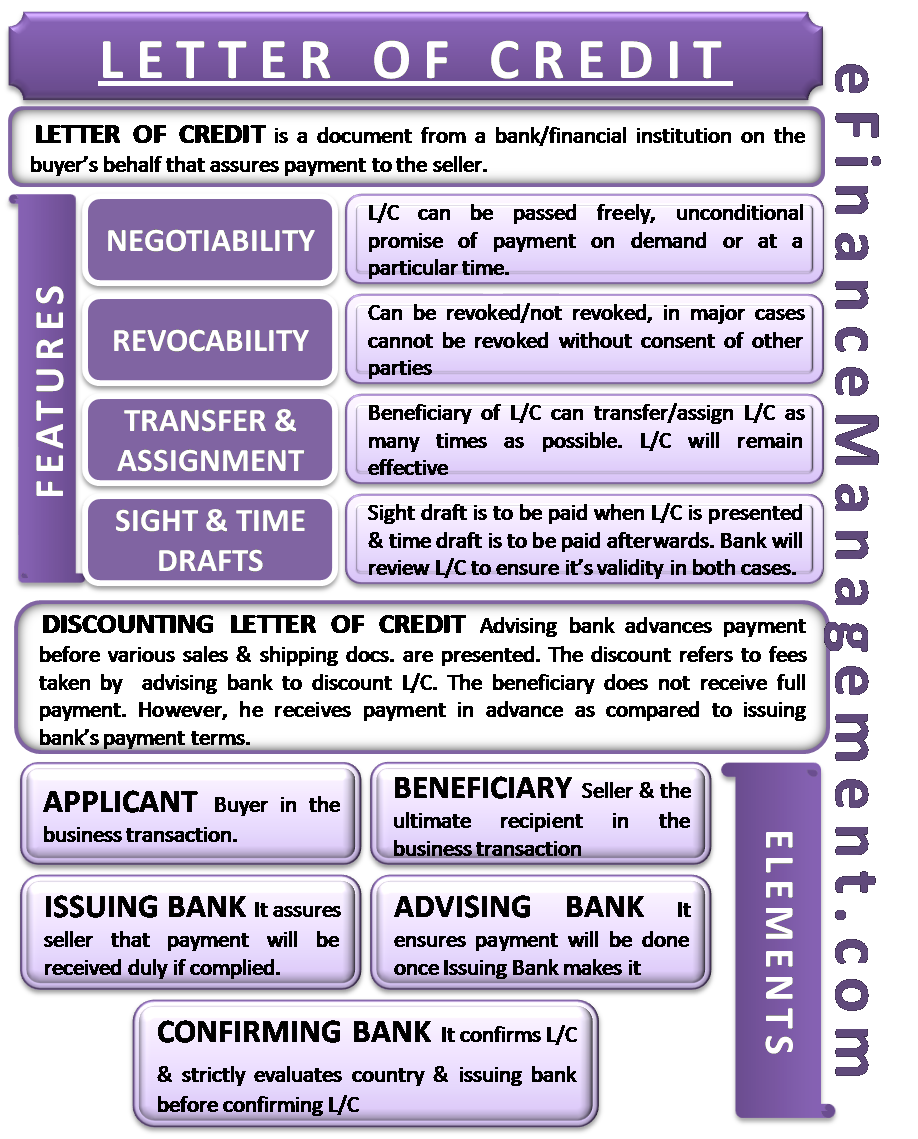

A letter of credit is a document from a bank that guarantees payment. A letter of credit or credit letter is a bank guarantee that a specific payment will be made. Being usually used for large international exports and transactions often loans can be taken to procure such letter of credit from the concerned bank.

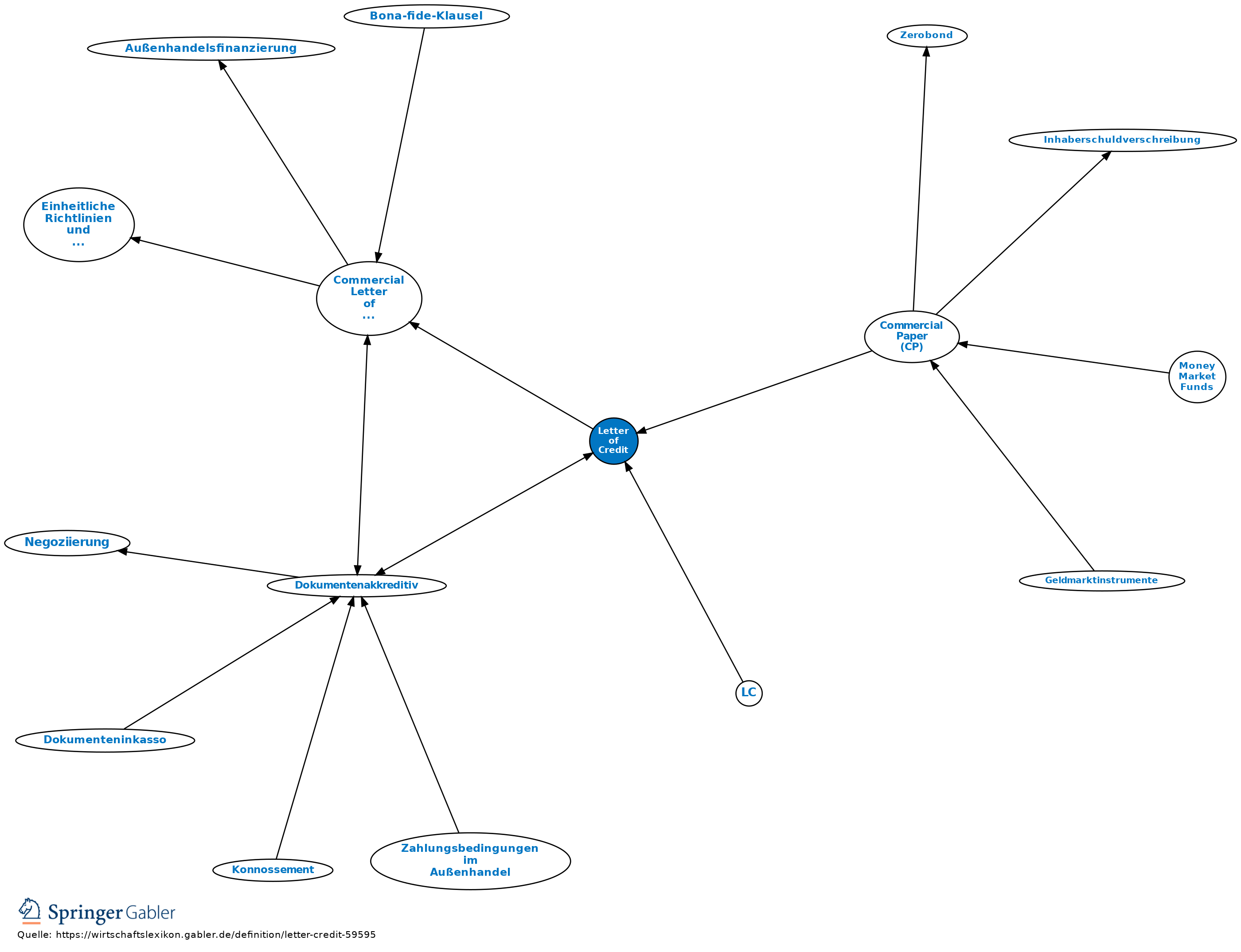

Types of Letters of Credit Commercial Letter of Credit. Sellers inability to control the shipping document for payment. Travelers Letter of Credit.

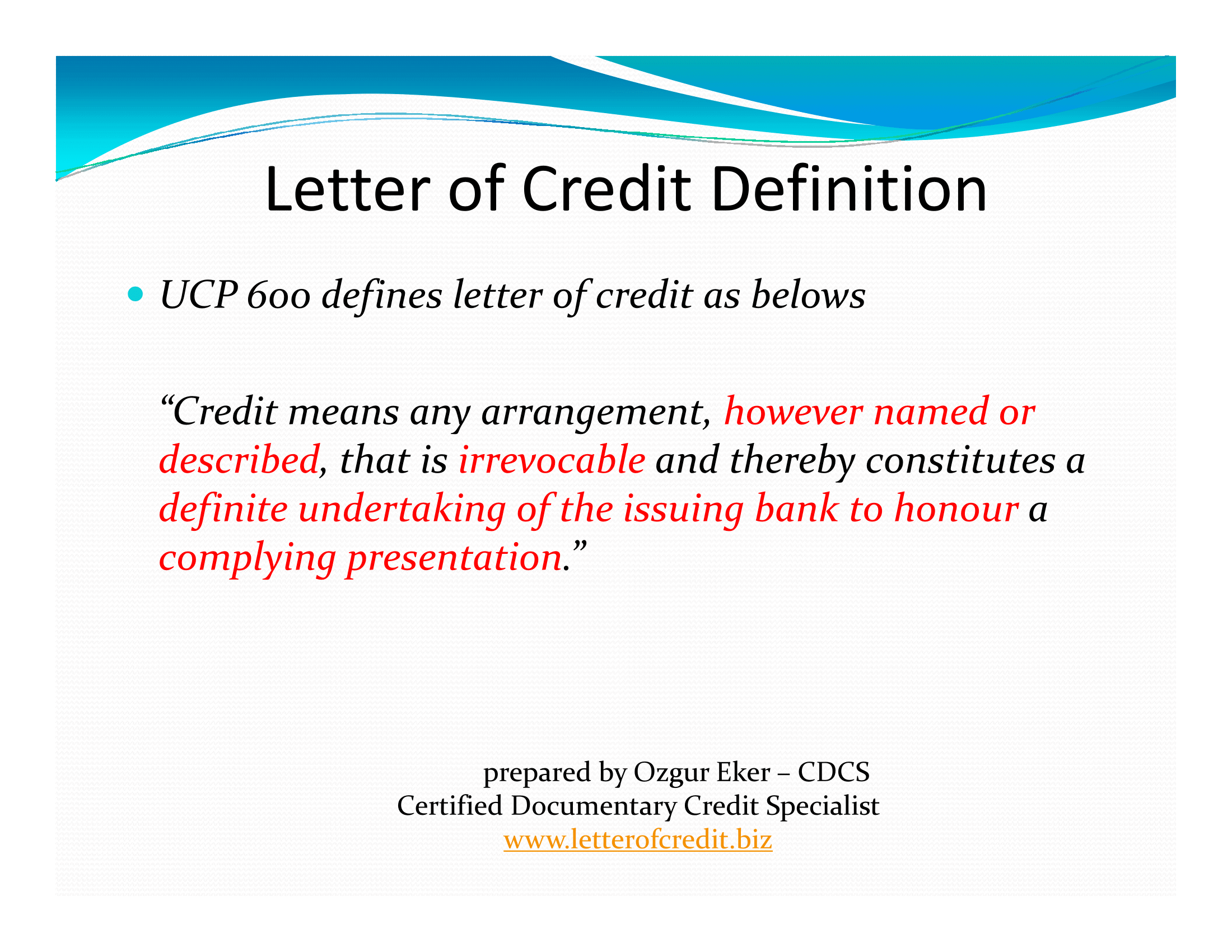

As a business owner you may request a letter of credit from a customer to guarantee payment for products or services youre providing. The technical term for Letter of credit is Documentary Credit. A letter of credit is a document given by a bank to its customer usually a buyer guaranteeing payment to a seller upon the presentation of documents.

Revolving Letter of Credit. This kind of letter allows a customer to make any number of draws within a certain limit. With a letter of credit buyers and sellers can reduce their risk ensure timely payment and be more confident about reliable delivery of goods or services.

This is a direct payment method in which the issuing bank makes the payments to the. Major problems if used with a Letter of Credit. A written instrument from a bank or merchant in one location that requests that anyone or a specifically named party advance money or items on credit to the party holding or named in the document.

In this Bank gives a guarantee to pay to the seller for the buyers obligation In case a buyer fails to make the payment. Learning about different types of letters of credit can help you choose which one to use and understand what youre working with. A confirmed letter of credit is one where a second bank agrees to pay the letter of credit at the request of the issuing bank.

Buyer is not required to disclose any export information or details regarding the export of the goods. A letter of credit or LC is a written document issued by the importers bank opening bank on importers behalf. A revolving letter of credit is a single letter of credit that covers multiple transactions over a long period of time.

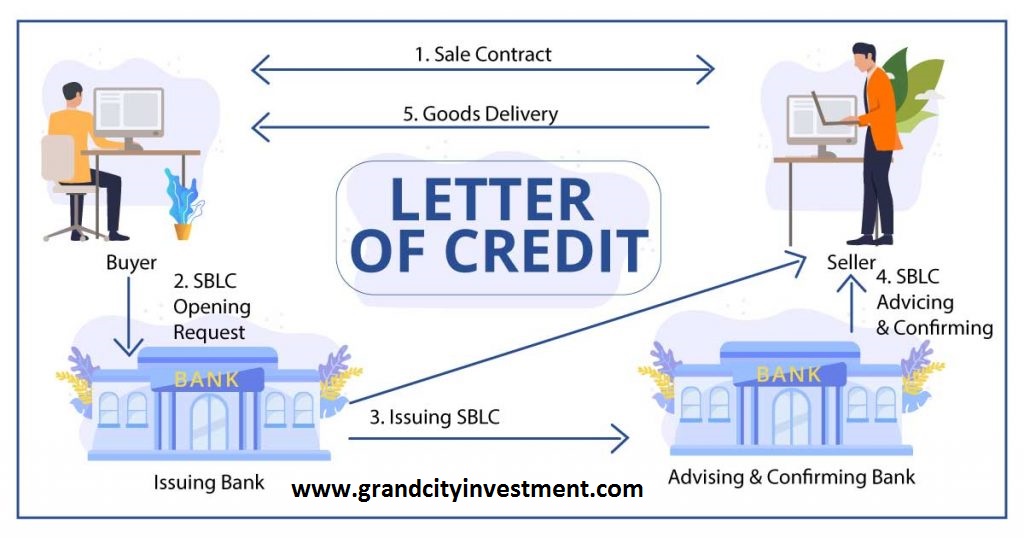

Letters of credit are another way of managing risk. It is basically a mechanism which allows importersbuyers to offer secure terms of payment to exporterssellers in which a bank or more than one bank gets involved. So LC discounting takes away the risk.

They can offer a guarantee to the seller that they will be paid and the buyer can be sure that no payment will. Letters of Credit also known as Documentary Credits is the most commonly accepted instrument of settling international trade payments. It gives assurance to the seller for the funds.

There are several types of letters of credit and they can provide security when buying and selling products or services. The EXW term is never involved with an AWB or OBL. A banker issues the letter of credit as the financial document.

The shipper will likely be required to present an AWB or OBL. Updated June 20 2020. The cost of a letter of credit usually ranges from 025 to 2 depending on the type of letter of credit margin customer credit rating tenure and other such factors.

Such an instrument is used in international trade. When a letter of credit is used repayment of the debt is guaranteed by the bank or merchant issuing it. When a letter of credit is issued the issuing bank requires the buyer to have cash in her account or credit available on a credit line to satisfy the payment amount.

It is issued by a bank and ensures timely and full payment to the seller.

What S A Letter Of Credit Infographic

Letter Of Credit Meaning Types How Does Lc Work

What Is Letter Of Credit The Ultimate Faq Guide Bansar China

What Is Letter Of Credit Types Characteristics Importance

Letters Of Credit Explained Open To Export

/letter-of-credit-474454659-ac5d6f45ce244478af87f92f1392884c.jpg)

Standby Letter Of Credit Sloc Definition

:max_bytes(150000):strip_icc()/how-letters-of-credit-work-315201-final-5b51ed66c9e77c0037974e85.png)

How Letters Of Credit Work Definition And Examples

What Is A Letter Of Credit And How Does It Work Leverage Edu

International Investment Bank Iib Iib Provided Post Financing Under Letter Of Credit

Letter Of Credit Definition Features Elements Discounting More Efm

Learn The Significance Of Letter Of Credit In Thailand By Merchant Trade Guarantee Corporation Company Ltd Medium

Letter Of Credit Definition Gabler Banklexikon

What Is A Letter Of Credit How It Works And Who Needs It

Letter Of Credit Lc Dlc Sblc Usance Lc Grand City Investment Ltd

Letter Of Credit A Tool Of Trade Finance

Learn About Different Types Of Letters Of Credit By Merchant Trade Guarantee Corporation Company Ltd Medium

Presentation What Is A Letter Of Credit Letterofcredit Biz Lc L C Page 4

Post a Comment

Post a Comment